Isn’t opening & closing credit cards terrible for your credit?

If there was one reason I would put at the top of the list as to why people are hesitant to start applying for more credit cards, it’s because they heard “opening and closing credit cards is REALLY bad for your credit”.

If someone says that to you (or if you say this yourself), I dare you to ask them (or you), “do you know what’s considered a good score vs a bad score? How is credit score calculated?”

Most people who believe this haven’t done research on credit scores. It’s more fear of the unknown.

Your credit score is defined as a “3 digit number generated by a mathematical algorithm using information in your credit report”. Lenders look at this number and determine how risk worthy you are in holding credit, and myFICO.com states “90% of all financial institutions in the U.S. use FICO scores in their decision-making process”.

There are 3 major credit agencies that create your scores: Experian, Equifax, and Transunion.

FICO scores can range from 300-850, and most people fall in the range of 600-750.

740+ Excellent Credit

700-740 Good Credit

650-700 Average to Poor Credit

600-650 Poor Credit

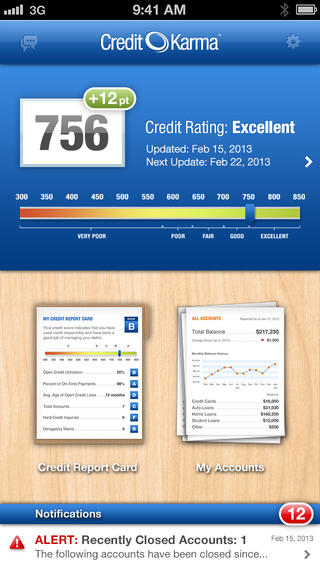

You’re probably wondering what your own credit score is now. You can check once annually for free at Experian.com. Other than Experian, I check my “fake” credit scores on CreditKarma & CreditSesame regularly. I call them “fake” because they don’t give you your actual credit scores, but they use an algorithm to come up with a good estimate, so its a good (free) way to keep up to date on what your credit score might be year round. They both have iOS apps too!

(Credit Sesame App – Sample FYI this is not my own screen shot but one I found online)

(Credit Karma App – Sample)

If your score is above 740, there’s no reason you shouldn’t be taking advantage of how credit worthy you’ve proven yourself to be up to this point. You don’t get a bonus or a pat on the back for having a credit score of 800.

Whatever your score might be, let’s get a closer look at how a FICO scores gets broken down.

New Credit – 10%

According to this chart, new lines of credit only account for 10% of your credit score. In my own experience, new accounts have dropped my score from 5-10pts for a couple of months, then it’s always rebounded after regular payments, and general good credit practices. Same thing with credit card closures.

Length of Credit History – 15%

Since length of your credit history combines for 15%, it’s always good to keep your accounts open for as long as possible. I always keep my credit cards open for at least 1-2 years (or as long as they’ll keep waiving the annual fee), and I never get rid of my oldest “no fee” cards. They always keep my average age of accounts high. If you’re signing up for a card solely for the bonus, annual fee’s don’t usually hit until the year mark so I advise against closing the card immediately after the bonus posts to your account.

Payment History – 35%

Payment history is the biggest component of your credit score calculation at 35%, so NEVER forget to make a payment. If you do, pay as quick as possible. This is something that’s in your control, so there’s no reason not to be on time 100% of the time. Remember, you’re responsible right? 🙂

Amounts Owed – 30%

The amount you owe is also a huge component at 30%. With this in mind, new accounts will actually even help you. If you get approved for a card with a large credit line, your credit utilization is going to go down, since the percentage of available credit in your accounts will decrease. (Example – if you currently have $10k in available credit & charge $1k on average / month, you’re at 10% utilization. If you apply for a new card that gives you another $10k in credit, that gives you $20k in total available credit. If you’re still only charging $1k/month, your utilization now goes down to 5%)

I’m not a financial advisor or credit analyst so please take this information for what it’s worth. Personally, I’ve applied for and been approved for a ton of new cards over the last few years. I’ve yet to be denied once at this point because I try to stay on top of the rules of when to apply, and how long to wait before I apply again.

If you want more information on credit, check out the links below, as those sites are a lot more credible than I am (Ha!).

Sources:

– MyFICO

– BankRate

– Experian

So there’s my little Point2Steve credit lesson 101. Are you still afraid to apply for a new credit card because “its bad for you”?

If you’re not, there are still a couple of things to consider before clicking those APPLY NOW buttons you see all over the web (or on my credit cards page). Some things I would consider are:

1. Are you going to apply for a large loan anytime soon? For a house or a car? If you do have plans to take out a large loan soon, I would slow down with the applications 6 months to a year in advance. Let your credit stabilize, and show lenders that your accounts show a good history of payments and no major changes. If you’re on the conservative side, maybe a year to 18 months.

2. Look at your score. If your score is below 700, I would work on increasing your score first. If you’re above 700, you’re in a good position to play this game. If you’re in the 750+ range, you’re in a great position.

What do you have to lose?

Sure, you’re going to get a slight ding on your report for a short period of time, but what is 770 vs 760? To most lenders who will just say 740+ will get the best rates, nothing. Your score will rebound from a credit inquiry.

What do you have to gain?

I generally don’t like to apply for a card unless I know I’m going to get more than $400 in value out of it, often much more. So $400-$4000 towards a vacation for a temporary credit drop? Sure I’ll take it.

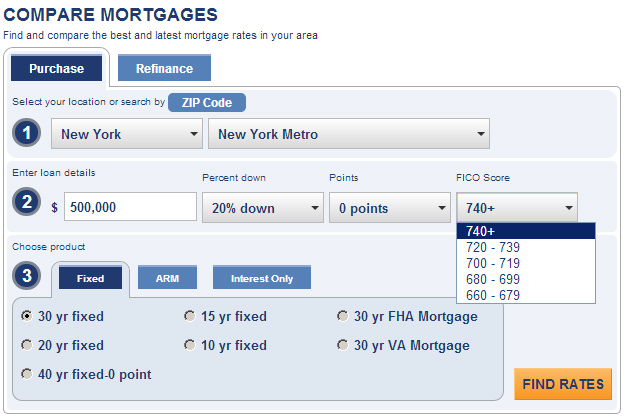

I just went to Bankrate.com to check mortgage rates for taking out a 30 year fixed $500,000 loan in NY. They’ll give you interest rates based on your score.

You don’t even have the option to select a range higher than 740+! After that, lenders will look into other things to determine how credit worthy you are. This is what you’re “saving” your credit score for right?

Some of you still aren’t convinced & never will be, and I’ve come to terms with that. But for those of you on the fence, tell me what else is holding you back?

The number 1 reason why most people don’t go on vacation is due to financial situations, it’s just too expensive. I haven’t completely removed that component, but I think I’ve found a way to make it affordable for any reasonable low-middle income person or family.