The American Express Platinum, & a boatload of benefits

I mention the AMEX platinum card over and over again, so I figured it would be useful to come up with a post dedicated to the card instead of sprinkling you with bits here and there. If you travel even a couple of times a year, there’s a ton of value in the AMEX platinum card. It’s by far my favorite card, and one I always keep with me because of the benefits it provides.

Most people get scared away once they hear a $450 annual fee, but you have to consider what you’re getting back.

Here are the boatload of benefits explained in no particular order. I’m going to guess there are so many that you get tired of reading before you make it through all of them:

1. $200 annual airline incidental credit – you contact AMEX to designate an airline every calendar year. During that year, AMEX will reimburse you up to $200 in airline incidentals such as baggage fees, in flight food & entertainment for that airline. In the past, I’ve purchased $200 in American Airlines gift cards, and those have also been reimbursed even though they state gift cards are not eligible. This effectively brings your annual fee down to $250

2. Priority Pass Select / Airport Lounge access – you are given airport lounge access via your AMEX either by the AMEX platinum card itself, or through the priority pass select program (which you have complimentary benefits to). This is probably the biggest benefit to having the card. Airport lounge visits cost anywhere from $20 – $50 per person, per visit. Earlier this year, I mentioned how the AMEX centurion lounges were now open to Platinum card holders, and that was a huge add on to the lounge program. Personally I find that lounge access makes my travel experience so much better by giving me a place to get a quick snack & drink, and to relax a bit before my flight. There’s no reason not to get pampered before you get to your destination. Fly a few times a year, and this benefit can easily cover the cost of your AMEX membership by itself. You’re currently allowed in American / US Air / & Delta lounges via your AMEX card, but American & US Air (which are merging) will end this benefit come March 22, 2014.

In the past year alone, I’ve visited more than 10 lounges in the US and in Asia (oh hello Singapore).

3. Global Entry / TSA Pre / Sentri – If you hate long lines, this is going to be a big benefit for you. Going through customs and security check at airports always puts a drag on my trip. Lines are usually really long, you have to take off your coat, shoes, laptop out of your bag, etc etc. With Global Entry and TSA Pre, it eliminates a lot of that hassle. When going through customs, you go through a quick Global Entry line. When traveling domestically where TSA Pre is available, you no longer have to take off your coat and shoes, and you can leave your laptop in your bag. Global entry applications are $100, which gets reimbursed to you (and all additional card holders).

After the last three benefits, your travel experience should be, get to the airport, check in, hang out at the lounge for some pampering and free stuff, go through a speedy TSA Pre security check, then board your plane. Does traveling sound better already? Keeping reading, there’s a lot more. And if you haven’t noticed, this card has pretty much paid for itself already.

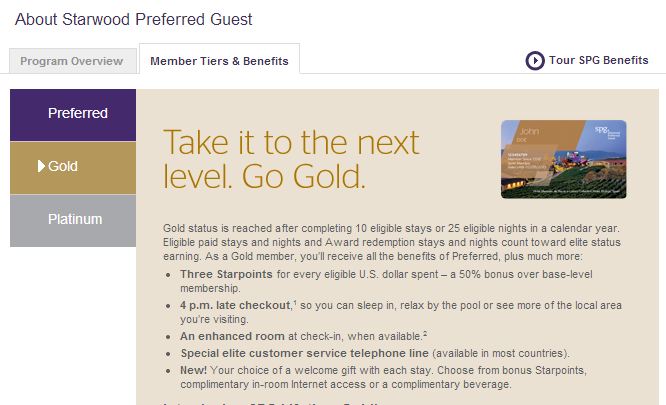

4. Starwood & Hilton Hotel Elite benefits – who doesn’t like to be treated like VIP, get upgrades, get free breakfast, free internet, free drinks? The AMEX platinum gives you complimentary Starwood SPG gold status, and Hilton gold status. SPG’s mid tier gold isn’t as rewarding as Hilton’s mid tier gold, but either way you will have a better experience and chance of getting upgraded if you stay with these brands and have elite status. Normally attaining these would require several nights/stays within the brand.

5. Extended Purchase Protection – I put all of my electronic and big purchases on my AMEX platinum because of the 90 warranty they put on items. You lose it, you break it, it’s stolen, AMEX will either ask you to send it in, or just reimburse the amount you charged for the item to your card. Simple as that. They also provide extended warranty for up to a year above a manufacturers warranty.

6. Roadside assistance – oh who cares about this benefit? ME! I actually had to put it to use earlier this year. AMEX will tow your car free of charge for 10 miles. I needed to have my car towed from NJ to NY, and most quotes I received were $350 + tolls both ways. AMEX found a vendor they work with that only charged me $72. I never realized how important this benefit was until then. I also had to pay $80 for a local tow company to get me off state property first, but AMEX is reviewing that charge right now. Still pending, but I plan a whole separate post for this experience.

7. Fine Hotels & Resorts Benefit – If you like staying at hotels like the W, Ritz Carlton, St. Regis, Shangri-la, Four Seasons, etc (you get the point by now), AMEX has partnered up with several of them to offer you a nice benefits package when staying at these hotels. You have to use a portal to log in and check availability. This isn’t for discount travel. Often the rates are similar to what’s posted on actual websites, but this offers elite like benefits without having elite status. That means early check in, welcome gift, free dinner, actually room upgrades, late check out, sometimes even a free night on a 3-4 night stay. I’ve used this before in Las Vegas and have had a wonderful experience.

8. AMEX Concierge Service – I wrote about the AMEX Black card here, and how they have a concierge service. Guess what? As a Platinum card holder, you’re entitled to pretty much the same concierge service. This is a useful tool to help you save time doing research and calling for reservations. Don’t expect them to perform miracles, but this can definitely make your life easier when you’re in an area trying to enjoy yourself rather than plan.

Believe it or not, there’s actually more, but these are the big benefits. I don’t think any other card on the market offers as much as the AMEX platinum. Without getting into detail it also offers:

– Currently offering complimentary Amazon Prime membership

– No foreign transaction fees

– Limousine program (not complimentary)

– By invitation only events (sports / culinary / concerts)

– Complimentary subscription to Departures magazine

So you probably think I’m going to recommend signing up for the card RIGHT now. No, wait for a better bonus offer. Currently it’s only 25,000 points after spending $2000 in 3 months. I signed up when it was a 100,000 offer. I’m confident that offer will spring up, but you have to be ready to sign up immediately when it does. If you don’t keep on top of it, I would at very least wait until a 50,000 point offer pops up.

Insist on having it right now? Fine, I do have a link on my credit cards page. 🙂 Just click Airline travel cards, and it’s in the middle of page 3. Thank you again if you’re using my links.

You could always “try” the card out for half a year and cancel. AMEX would then prorate half the fee back to you. Does the $450 annual fee still scare you?